Whoa, this hits hard! I’ve been watching BNB Chain traffic more than usual lately, and the volume tells a messy story that isn’t obvious at first. PancakeSwap swaps, hasty approvals, and tokens popping up everywhere make for an anxiety-inducing feed. At first glance the memecoins look fun and harmless, but dig deeper and you quickly see patterns that scream “watch out” to anyone who cares about funds. Here’s what I keep checking when I track transactions closely.

Seriously, this matters. Transaction timing often tells you whether a bot or a person is involved, because bots create telltale clusters of near-identical timestamps that are hard to fake. Look at the gas spikes, the nonce jumps, and liquidity additions or sudden burns to piece the story together. I once followed a chain of tiny transfers between wallets and contracts and realized that they were gradually draining liquidity before a big swap collapsed the pool, which was ugly and educational all at once. That moment taught me a lot about on-chain sleuthing, somethin’ I still think about when I check new contracts.

Hmm… interesting observation. Initially I thought the PancakeSwap tracker dashboards were overkill for casual users, and I assumed only bots and whales cared about chain-level debugging. But then I realized that even simple checks stop a lot of very very costly mistakes because approvals and router addresses hide the most dangerous shortcuts. Actually, wait—let me rephrase that: the tracker reduces cognitive load and flags anomalies, so you don’t have to eyeball every approval and token transfer manually while losing sleep over phantom transactions. My instinct said the extra layer was worth it, even with the noise.

Tools I Use, and where I look for proof

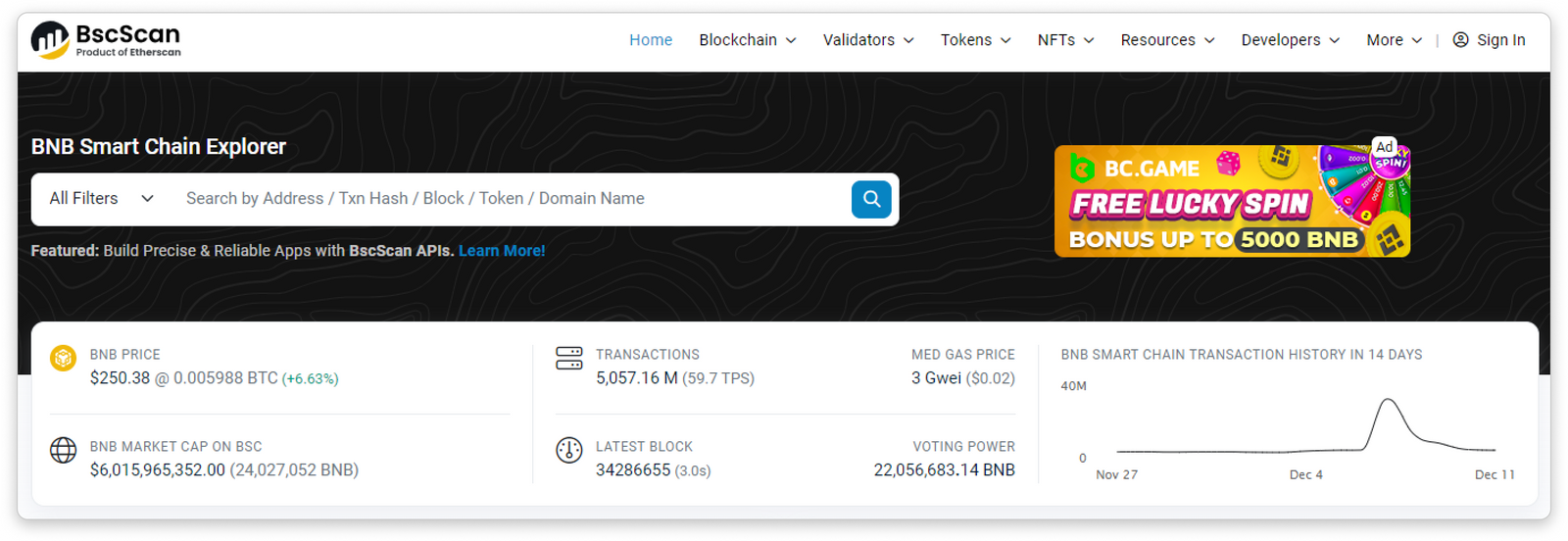

Okay, so check this out—use an on-chain explorer to follow token contracts, approvals, and liquidity events because raw hashes without context are almost useless. The tool shows you input data, logs, and the exact wallet addresses interacting with pools so you can map intents. When I need a reliable look at transfers on BNB Chain I hit the bscscan block explorer because its traceability features (and familiar interface) help me map token flows across BEP-20 contracts and spot suspicious approvals before they become catastrophic. That one move often saves people from irreversible mistakes and gives you a fighting chance to reverse or report sketchy behavior.

Here’s the thing. BEP-20 tokens are straightforward standards but they hide complex interactions in contract code that only show up on-chain when you inspect events and logs. Watch approvals closely, revoke what looks risky, and double-check router and factory addresses before swapping, because the worst problems start at the approval step. On one hand speed and low fees on BNB Chain make tooling like PancakeSwap trackers indispensable for active traders, though actually there are times when over-monitoring causes paralysis by analysis and you miss the forest for the trees. I’m biased, but skepticism helps when new tokens appear in your wallet; question the strange transfers and don’t trust a shiny price chart alone.

FAQ: Quick answers to common on-chain tracking questions

How can I tell if a PancakeSwap pool has been manipulated?

Look for sudden liquidity additions paired with large owner-controlled token transfers, and scan the contract’s transfer events for repeated tiny moves that precede big sells; those are common red flags. Also check who owns the LP token and whether the liquidity was renounced or locked, because an unlocked LP is a big risk.

What should I do if I see an unknown BEP-20 token in my wallet?

Don’t panic—tokens can be airdropped or reflect contracts, and many are harmless. Pause, check the token contract code and holders, verify the token on explorer events, and if approvals look dangerous revoke them (trust me, it’s saved me a headache). If you’re not 100% comfortable, move on and avoid interacting until you’re sure.