Wow! I got hooked on Solana because transactions feel fast and cheap. But honestly, that speed can lull you into risky shortcuts if you’re not careful at all really. Initially I thought browser extensions were fine for day-to-day swaps, but then realized they expose your seed or private key when malicious sites inject scripts or when approvals are sloppy, so the attack surface widens dramatically. Use small amounts for testing, and then scale up slowly as you gain confidence in protocols.

Whoa! Browser-based wallets are convenient for DeFi interactions and staking dashboards. You click, sign, and boom—your position changes in seconds which feels great. On one hand that immediacy is magical for yield farmers chasing APYs, though actually it also tempts people into approving wide-ranging permissions that bad actors can exploit without you noticing. My instinct said be cautious, so I used small test transfers first.

Really? Permission granularity matters more than most people assume in wallet popups. When a dApp asks to “use all your funds” I get annoyed and click cancel. Here’s the thing: some protocols need broad approvals for contract mechanics, but you can still mitigate risk by using spend limits, time-limited approvals, and intermediate vaults that isolate large balances. I prefer wallets that show contract addresses plainly and let me audit the approval before signing.

Hmm… Extensions inject convenience but also more persistent session state than ephemeral hardware wallets. That persistent state means a compromised browser extension or malicious plugin can sniff and phish approvals over multiple interactions. Seriously? I saw a case where a malicious Tamper extension replaced contract addresses with ones pointing to drainers, and it took a while to spot. The fix was tedious but effective: create a dedicated browser profile for DeFi.

Wow! Staking on Solana is attractive because lockups are usually short and yields compound fast. That convenience makes browser wallets tempting for daily delegation and quick unstake tests. But remember that a browser extension, even a well-vetted one, increases attack surface and can expose your delegation approvals if malicious code intercepts or fakes transaction data, so vigilance is required. So I split funds: small pots in extensions and main stake offline.

Really? Not all browser extensions are created equal when it comes to code audits and community trust. Audits are encouraging, but audits alone don’t fix runtime behaviors or clever social engineering attacks. Initially I thought an audited extension meant full safety, but then I saw a coordination attack that abused user prompts and realized audits are part of a layered defense, not a silver bullet. Check extension update histories and changelogs before using them for significant staking.

Whoa! Simpler UX means more automatic approvals in many wallets, and that simplicity can backfire. Permission fatigue is real—people click approve without reading details because there are so many popups. On the other hand, advanced users can enable advanced prompts or require on-device confirmations to restore some friction, which paradoxically protects funds by forcing micro-decisions that block scripted drains. My habit now is to delay approvals, verify contract addresses, and breathe before confirming.

Hmm… Using a hardware wallet with a browser extension bridge feels like the best compromise to me. The hardware signs transactions offline while the extension manages the dApp interactions, reducing exposed keys during complex flows. I’m biased, but combining cold-key control and hot-interface convenience gives the best of both worlds for staking and interacting with DeFi. Still, ensure your hardware firmware is current and verify transaction payloads on-device.

Wow! Some DeFi protocols ask for unusual approvals that can route rewards to third parties or wrap funds unexpectedly. A layered defense means batch approvals, time-limited permits, and using wrapper contracts you inspect yourself. Okay, so check this out—one protocol once offered auto-compounding via a delegated agent, which sounded handy until I noticed withdrawal limits and fee-take that eroded APY over months, so my “high yield” was actually mediocre after protocol fees. Lesson learned: read token economics and contract code summaries before trusting automated yield services.

Really? The Solana ecosystem has many emerging liquid staking protocols and derivative tokens. These offerings can amplify yields but add counterparty and smart-contract layers that increase systemic risk. Initially I thought stacking derivatives was a smart leverage play, but then I realized compounding failure modes could correlate and wipe out most gains if a major pool suffers a flash exploit. Keep positions diversified and limit exposure to any single protocol to protect staking returns.

Whoa! Gasless transactions and pay-for-transaction models in some dApps can obscure who ultimately pays fees. That opacity became a practical problem when a service fronted fees and later altered withdrawal conditions unexpectedly. On one hand convenience reduces friction for small traders, though actually it means you must read TOS and on-chain logs to confirm there are no surprise claims on your rewards. I avoid services that hide fee mechanics behind marketing terms.

Hmm… For active DeFi users, session isolation is gold: separate browsers, OS profiles, or even VMs. This seems extreme at first, but it greatly limits cross-site contamination and stolen cookies. On the other hand maintaining multiple profiles is annoying, though actually the small friction pays dividends because attackers often rely on convenience to scale their exploits. Pro tip: bookmark trusted staking dashboards and avoid clicking signed-in links from chats.

Wow! Mobile wallets add convenience but sometimes lack advanced approval controls present in desktop extensions. If you bridge between mobile and desktop wallets be mindful of key export options and QR transfer slips. My instinct said never export seeds unless necessary, and that gut call saved me from copying my main key to a cloud clipboard during a hurried move. Instead use cold storage for large stakes and reserve mobile for small positions.

Really? Community reputation, open-source code, and active maintainers usually indicate a healthier extension project. But projects can shift focus, change maintainers, or be acquired, which makes ongoing vigilance necessary. Initially a project I trusted published a rushed update that introduced a UX regression, and though the team patched it, the incident reminded me that trust is ongoing and not a one-time checkbox. Watch GitHub activity and community channels for sudden changes or unusual release cadence.

Whoa! Consider multisig solutions when multiple stakeholders manage pooled staking or treasury funds. Multisig raises the bar for attackers and distributes social responsibility across signers. On one hand it complicates routine actions and increases coordination costs, though actually that friction is often a feature because it prevents rapid single-point-of-failure drains. For smaller users, threshold-signers with hardware devices strike a good balance between security and practicality.

Hmm… Backup procedures are boring but life-saving; write down seeds, encrypt backups, and store them offline. I once lost a laptop and was relieved my backups worked. My advice: rotate backups, test restores yearly, and avoid putting seeds in cloud storage unless encrypted thoroughly. Somethin’ about redundancy feels tedious until it becomes the only thing between you and disaster.

Wow! Choosing the right browser extension is a tradeoff among UX, audit depth, and community trust. I like wallets that present transaction details clearly and have explicit fine-grained spending caps. Initially I thought more features always meant better security, but then I realized fewer features with stricter prompts sometimes produce safer outcomes for average users who otherwise accept defaults. Check whether extensions support hardware wallet integration before you commit significant stake.

Really? Explore staking pools’ on-chain histories and withdrawal frequencies to avoid surprises. Some pools compress rewards or rebalance often, causing temporary negative events during volatility. On the other hand yield aggregators can improve APY but add operational risk that requires trust in the aggregator’s timeliness and security practices. If you’re chasing yield, set a maximum exposure and be ready to exit when risk metrics spike.

Whoa! Phishing clones of popular extensions and fake update prompts are common and clever. One time I nearly installed a fake extension because it mimicked branding perfectly and had fake reviews. My gut told me somethin’ felt off, so I compared the developer key and repository before proceeding, which saved my funds. Always verify extension sources and prefer official stores or direct project pages.

Balancing Convenience and Security

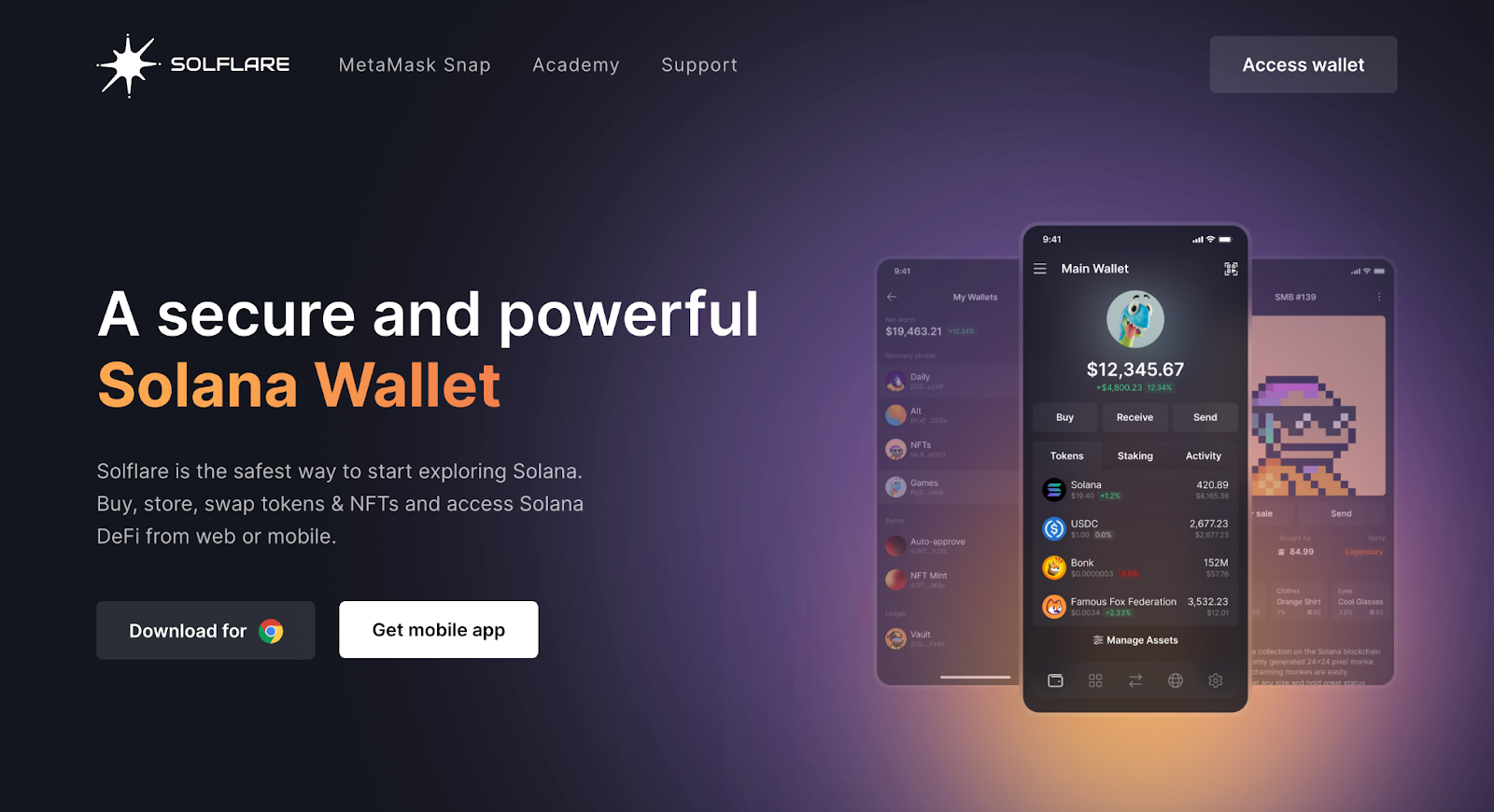

Hmm… At the end of the day staking and DeFi are about balancing convenience with survivable risk. I’m biased toward safety for long-term stakes and experiment with small amounts in extensions. This is why I recommend wallets that integrate hardware signing and clear approval flows, like the solflare wallet, because they let you manage staking rewards while keeping keys out of reach of web threats. Takeaways: separate profiles, use hardware keys, verify approvals, limit exposure, diversify protocols, and test restores—then sleep better.

FAQ

Can I stake directly from a browser extension?

Yes, many extensions support staking flows and delegation, but consider using hardware-backed signing or splitting stakes so that large amounts remain offline to reduce risk.

Are audits enough to trust a wallet extension?

No. Audits help, but runtime behaviors, update practices, and community trust matter too. Use layered defenses like hardware integration, session isolation, and manual verification of approvals.